On June 14, Finance minister Matia Kasaija presented to the nation a Shs 48 trillion for FY 2022/23 on behalf of President Museveni at Kololo ceremonial grounds. Below is his speech verbatim with slight edits.

Madam speaker, in fulfillment of Article 155(1) of the Constitution, I have been delegated by HE the president to present to parliament, the budget for the FY 2022/2023. My statement today highlights the budget as approved by parliament on the 20th of May 2022.

Rt Hon speaker, on 20th March 2022, we lost a gallant son and speaker of this august House – the Late Rt Hon JacobL’Okori Oulanyah. I request that, once more, we observe a minute of silence in his memory. May his soul rest in Eternal Peace.

Rt. Hon. speaker, the NRM government’s overriding goal is to achieve socio-economic transformation for the benefit of all Ugandans and thus improve their lives. We must therefore quickly accelerate the economic recovery that we began in FY 2021/2022, integrate more Ugandans into the money economy, and speed up growth in the country’s productive sectors.

Madam speaker, the theme of the budget for FY 2022/2023 is, therefore “Full Monetisation of Uganda’s Economy through Commercial Agriculture, Industrialisation, Expanding and Broadening Services, Digital Transformation, and market access”.

This theme summarises our budget strategy and the priorities that I will later elaborate on. The theme is in line with that of the East African Community (EAC) which is “accelerating economic recovery and enhancing productive sectors for improved livelihood”.

Madam speaker, to achieve Uganda’s socio-economic transformation, the NRM government has resolved to pursue the following goals in the forthcoming year and the medium-term: i) Kick-start the process of getting the households still engaged in subsistence into the money economy, ii) support businesses and the overall economy to recover from the impact of the COVID-19 pandemic and restore the lost jobs and livelihoods, and iii) protect households from the rising prices of food, fuel, and other essential commodities using prudent economic policies.

Madam speaker, to achieve these goals, the following key strategic actions will be undertaken: i) maintain peace, security and stability, which jointly are the foundation of all other government, business and household plans; ii) full implementation of the Parish Development Model (PDM) to accelerate the transition of the 39 per cent of households still engaged in the subsistence economy into the money economy; iii) step up implementation of the relief and recovery funds to support the recovery of businesses and restore the lost jobs and livelihoods.

These relief funds include the Small Business Recovery Fund; the Emyooga Fund; Microfinance Credit to SACCOs; the Uganda Development Bank (UDB) and Uganda Development Corporation(UDC), debt and equity funds, respectively; iv) implement appropriate fiscal and monetary policies to mitigate the impact of price shocks on the wellbeing of ordinary Ugandans, without causing long-term distortions in the economy; and v) enhance investment in infrastructure to facilitate increased production, value addition, and national and regional market access and entry.

Madam speaker, in this budget statement, I will do the following: i) report on the performance of the economy and review our future economic prospects; ii) provide progress in the implementation of the development programs that we promised the people of Uganda during the last FY 2021/2022, and the priorities for the next FY 2022/2023; and iii) highlight the revenue and expenditure framework for the next financial year 2022/23, as approved by parliament.

RECENT ECONOMIC PERFORMANCE AND OUTLOOK

Madam speaker, I now wish to give highlight on the performance of the economy and accountability for measure I announced in the FY 2021/22 budget. The details can be found in the background of the budget 2022/23 which has been published. Economic Growth.

Madam speaker, the size of our economy is projected to expand to Shs 162.1 trillion for the FY ending 30th June 2022. This is equivalent to US Dollars 45.7 billion. Economic activity has been more buoyant at the growth rate of 4.6 per cent per annum this FY up from 3.5 percent of last year. This shows that the economy is on a path to full recovery from the COVID-19 disruptions.

Madam speaker, with this buoyant recovery and resilience of the economy—induced by our deliberate and prudent economic policies—Uganda’s GDP per capita has increased to US Dollars 1,046 in current prices, which is equivalent to Uganda Shs 3.7 million per person per year.

Madam speaker, the services sector is expected to grow by 3.8 per cent up from 2.8 per cent growth last financial year. This is on account of continued recovery in wholesale and retail trade, education and tourism services; coupled with growth in real estate activities and ICT.

The services sector is projected to contribute 41.5 per cent to GDP. The industry sector is expected to grow by 5.4 per cent up from 3.5 per cent growth last financial year, largely on account of the recovery in manufacturing and construction activities. The industry sector is projected to contribute 26.8 per cent to our GDP. The agriculture sector is expected to grow by 4.3 per cent, largely as a result of growth in food and cash crop production, livestock as well as recovery in fishing. This is the same rate at which the agriculture sector grew last year.

The sector contributed 24.1 per cent to total economic output.

Prices

Madam speaker, in the second half of FY 2021/22, however, there has been a significant increase in prices for some of the essential commodities and services. These include laundry bar soap, petrol, and diesel, cooking oil, and some food crop items such as wheat, sugar, potatoes, and onions. Education services and building materials such as cement and steel have also experienced price increases.

As a result, the overall inflation has increased considerably from 2.7 per cent in January 2022 to 6.3 per cent in May 2022, causing considerable discomfort among the public. Madam speaker, this recent increase in the prices of essential commodities is a result of events that have occurred outside Uganda.

These are: i) The effect of COVID-19 restrictions across the world, which disrupted supply chains, which has consequently caused a shortage of intermediate raw materials used to produce some essential commodities; ii)In the recent past, the global economy has faced high shipping costs arising from limited availability of containers, and higher fuel prices; all together leading to supply shortages globally;

iii) The full opening of economies globally following relative containment during the COVID-19 pandemic lockdowns has led to a rapid rise in aggregate demand for a number of fast-moving-goods beginning with oil, yet production levels have been constrained by Covid-19 restrictions; and iv) The situation has been worsened by the Russia-Ukraine conflict,which has further disrupted supply of oil, cereals such as wheat,maize, and sunflower oil, as well as essential metals like aluminum and nickel. The two countries are major producers and exporters of these commodities.

Madam speaker, appropriate measures to curb the rising prices in the short, medium, and long term will be implemented. These measures include i) Supporting farmers to grow more fast-maturing food and oil seeds to ensure sufficient domestic supply; ii) maintaining a market-based determination of prices to support a continuous supply of the goods and services. This is intended to ensure that demand does not outstrip supply; iii) expediting improvement of alternative fuel import routes across Lake Victoria to avoid possible unnecessary supply disruptions; iv) using appropriate fiscal and monetary policies to mitigate the impact of price shocks; v) construct additional fuel storage infrastructure in the medium term, and stock them adequately, and vi) expediting commercial oil production and development of the oil refinery.

Madam speaker, government cannot influence price levels whose changes are driven by external shocks that are outside its control. We will therefore not be applying measures that can lead to long-term and painful distortions in the economy. For examples persistent shortages of goods, hoarding, and black markets.

Exchange Rate Developments

Madam speaker, over the past year, the Uganda shilling initially strengthened against the US Dollar, appreciating by 2.3 per cent between April 2021 and April 2022. This appreciation was on account of higher dollar inflows from our exports, foreign direct investment, and foreigners buying Government treasury bills and bonds.

However, the shilling has experienced significant depreciation pressures since March 2022 on account of concerns arising from the Ukraine-Russia conflict and related sanctions as well as the rising interest rates in advanced economies. The shilling depreciated by 1.7 per cent month-on-month on average in the three months to June 2022 and by 6.7 per cent against the US dollar between June 2021 and June 2022. The Bank of Uganda is taking appropriate measures to avoid volatile fluctuations but not preventing the exchange rate movements.

Interest Rates

Madam speaker, commercial bank lending rates for shilling denominated loans marginally declined to 18.8 per cent in the 10-month period to April 2022, down from 19.1 per cent in the same period in the previous year. Reduction in lending rates occurred in the transport and Communication, Building, Mortgages, Construction and Real Estate, and Personal and Household Loans sectors. External Sector Performance.

Madam Speaker, total export receipts of goods and services amounted to US dollars 5.74 billion in the 12 months to April 2022, down from 6.2 a billion in the previous 12 months. Merchandise exports were reduced by US Dollars 858 million in the same period. However, coffee receipts increased from US Dollars 279.5 million to US dollars 811 million in the same period.

Madam speaker, private sector imports of goods have increased significantly to US dollars 6.4 billion in the year to April 2022 from US dollars 5.0 billion in the previous 12 months. This increase is attributed largely to investments in the oil and gas sector.

For the same reason, foreign direct investment has rebounded strongly to US dollars 1.36 billion in the year to April 2022 from US dollars 892 million in the same period a year before. Uganda’s international reserves at the end of April 2022 increased to US $4.54 billion, equivalent to about 4.6 months of imports. This was an increase from US dollars 3.57 billion as of April 2021.

Fiscal Performance

Madam speaker, the revenue collection target in the financial year2021/22 budget was Shs 22.425 trillion. Total revenue collection is now projected at Shs 21.486 trillion. This represents a shortfall of Shs 939 billion. Despite this revenue shortfall, domestic revenue collection this financial year has improved compared to last year. This has been on account of improved tax administration and increased economic activity following the full re-opening of the economy in January 2022.

Madam speaker, total government expenditure excluding domestic debt refinancing, external debt amortization and appropriation in aid is projected to amount to Shs 35.027 trillion this ending financial year. This expenditure is equivalent to 21.6 per cent of GDP. This is Shs 697 billion higher than the expenditure planned at the time of budgeting, mainly due to the need to finance the health requirements associated with the impact of Covid-19 pandemic, and to address internal and regional security threats.

Madam speaker, the fiscal deficit this FY 2021/22 is estimated at 7.3 per cent of GDP which is lower than the 9 per cent fiscal deficit registered in FY 2020/21. Our target is to reduce the fiscal deficit to 3 per cent in the medium term.

COVID-19 Mitigation Measures

Madam Speaker, government implemented several measures to mitigate the impact of the pandemic on households and businesses. These measures were aimed primarily at keeping Ugandans alive and also to restore business activity. To date, the outcomes of these measures are as follows: Health and Social Support Responses.

Madam speaker, government implemented robust actions to contain the COVID-19 pandemic and its effects on households. These actions included: i) Enforcement of COVID-19 SOPs and guidelines, and free mass vaccination. A total of 16 million people, equivalent to 72 per cent of the targeted 22 million persons have received at least one dose; ii) Provision of Shs 53.5 billion as cash relief grants to adversely affected people, including boda-boda riders, salon workers, food vendors, private school teachers, ghetto residents, and street vendors;

iii) Strengthening health care systems, including regional and national referral hospitals by equipping 143 Intensive Care Units (ICUs), upgrading of 255 Health Centre IIs to Health Centre IIIs, and the recruitment of 400 health workers; and iv) Funding scientific research and development, including COVID vaccines development and innovative therapeutics such as COVIDEX.

Madam speaker, during the pandemic, learning continued with the provision of home-learning materials across the country. Following the full reopening of schools, an additional 2,900 primary and secondary school teachers have been recruited and deployed to help the learners to catch up on lost time.

Restoring Business Activity

Madam speaker, to support recovery of the economy Government has provided credit relief to borrowers as well as funding to micro, small and medium enterprises (MSMEs) and corporate/large businesses.The following progress has been registered:i) Bank of Uganda extended credit relief to enable borrowers unable to service their loans during the pandemic to restructure them.

Loans totaling Shs 7.2 trillion, representing 40 per cent of total loans, were restructured over the period; ii) Domestic arrears to private sector suppliers of goods and services to government totaling Shs 526 billion were cleared.

In addition, court awards amounting to Shs 57 billion were settled; iii) The Microfinance Support Center (MSC) was funded to support micro-businesses through the Emyooga Fund (Shs 100 billion) and support to SACCOs (Shs 27 billion). Consequently, 6,600 SACCOs and 205,000 savings groups have been established across the country. These are operating a total of 4.1 million accounts.

As a result, savings worth Shs. 63 billion as at the end of April 2022 among the lowest earners of this country have been realized; iv) For small businesses that do not fall under Emyooga and at the same time do not qualify for the UDB funding, the Shs 200 billion.

Small Business Recovery Fund has been established in partnership with Bank of Uganda supervised financial institutions to offer credit at a subsidised interest rate of 10% percent per year;v) To support the recovery of medium and large-scale businesses, Uganda Development Bank (UDB) was capitalized to the tune of Shs 636 billion and which was fully disbursed by May 2022 at an interest rate of 12 percent per annum.

In addition, UDB plans todisburse a further Shs. 351 billion by December this year; vi) For private sector enterprises engaged in strategic industrial development of the country, such as agro-processing, manufacturing, and minerals beneficiation, the Uganda Development Corporation (UDC) received Shs 160.7 billion this financial year to make equity joint venture investments;vii) Government has also disbursed the Shs 20 billion to Teachers’ SACCO to support them to recover from the pandemic; viii) In the FY 2021/2022, the Agricultural Credit Facility disbursed a total of Shs 67.42 billion to 1,057 borrowers as at June 2022.

Cumulatively, the fund has financed a total of 3,120 farmers across the country to a tune of Shs 737.30 billion; ix) Following amendment of the National Social Security Fund (NSSF)Act to allow mid-term access for qualifying members, a total of Shs 420 billion has so far been paid out to about 21,500 beneficiaries; and x) For women entrepreneurs, I have received a US dollar 217 million grant from the World Bank to provide funding in the coming financial year to middle level businesses managed by women to support their growth and create jobs.

Madam speaker, as a result of the above measures, we have begun to see positive trends in business activity. For example, during the 10 months from July 2021 to April 2022, there was a 38 per cent increase in taxpayers with 686,000 new taxpayers being added to the tax payer register.

In addition, investors’ sentiments about doing business in Uganda have remained positive in recent months as illustrated by the following indicators between July 2021 and May 2022. i) The Business Tendency Index (BTI) which has increased by 20.8 per cent. The BTI measures the level of optimism that executive shave about current and expected outlook for production, order levels, employment, prices and access to credit;ii) The Purchasing Managers’ Index (PMI) which has increased by 48.8 per cent.

The PMI is an indicator of business activity both in the manufacturing and services sectors; and iii) The Composite Index of Economic Activity (CIEA) which has increased by 4.3 per cent. The CIEA represents the monthly underlying forces in the national economy. Medium-Term Economic Outlook. Madam speaker, future prospects for our economy are positive, with medium-term growth projected at 6.5 per cent per annum. The positive economic outlook is dependant on the following: i) The full reopening of the economy;ii) The increase in global demand for some commodities we produce and export, such as coffee, livestock, tea, and other food products;

iii) Commercialisation of oil and gas following the announcement of the Final Investment Decision (FID) in February this year; iv) Active import substitution for goods that Uganda can produce and export competitively, such as pharmaceuticals; v) Support to private sector industries particularly in agro-industry,light manufacturing and value-addition to our minerals; vi) Improved access to affordable credit for micro, small and medium enterprises to enable their businesses revive and create jobs; vii) Fast tracking the implementation of the Parish Development Model which targets increased production of strategic commodities for domestic consumption and export; and viii) Digitisation of the economy to realise efficiency gains in business and government.

FINANCIAL YEAR 2022/23 BUDGET STRATEGY

Madam Speaker, the Budget Strategy for the FY 2022/23and over the medium term seeks to restore economic activity to the pre-pandemic levels, and subsequently accelerate the pace of socio-economic transformation. The three broad objectives of the strategy are:i) Sustaining peace, security and stability as well as macro-economic

stability, as key foundations for recovery, growth and socio-economic transformation;

ii) Mitigation of the COVID-19 impact on business activity, livelihoodsand the overall economy; andiii) Speeding up socio-economic transformation by repurposing the budget towards wealth and job creation as well as other impactful investments.

Imperatives for implementing the FY 2022/2023 Budget.

Madam speaker, in order to achieve these three key objectives, the following imperatives must be adhered to:i) National budget reform to make it more re-distributive and responsive to national priorities.ii) Enhanced fiscal discipline to limit supplementary expenditure to only the unforeseeable and unavoidable spending within the 3percent provided for under the law. iii) Enhanced domestic revenue mobilisation to increase the revenue-to-GDP ratio to our target of 18 percent over the medium term.

iv) Limit the borrowing to restore the debt-to-GDP ratio to within 50percent over the medium term as provided for in the Charter for fiscal Responsibility.v) Continued alignment of the budget to the National development plan to ensure that our development priorities are adequately funded. vi) Automate Government processes and systems to enhance efficiency, save money, and fight fraud and other forms of corruption. vii) Rationalisation and restructuring of Government to eliminate duplication, overlaps, mandate wars and resource wastage.

FINANCIAL YEAR 2022/23 BUDGET PRIORITIES

Madam speaker, the key priorities for the FY 2022/23Budget are the following: i) Enhancement of security, the rule of law and fighting corruption; ii) Sustaining economic recovery; iii) Implementation of the Parish Development Model to create wealth and jobs; iv) Promotion of agro-industrialisation, standards and market entry; v) Commercialisation of oil and gas; vi) Enhancement of transport, energy and ICT infrastructure; vii) Enhancing human capital development, science, innovation, and knowledge transfer; and viii) Enhancing public sector effectiveness and efficiency.

Enhancing Security, the Rule of Law and Anti-Corruption

Madam speaker, peace, security, and stability as well as rule of law are the bedrock of socio-economic transformation, and thus must remain key Government priorities.

Peace, Security and Stability

Madam speaker, the recent surge in cattle theft and cross-border conflicts in Karamoja sub-region have been and will continue to bead dressed. In a recent supplementary budget, government provided Shs 112.5 billion to facilitate the UPDF to carryout operations and the ministry of Works and Transport to construct security roads in Karamoja sub-region. The UPDF will also continue with the pacification of the eastern Democratic Republic of Congo in line with the agreement with the government of the Democratic Republic of Congo.

Madam speaker, with respect to the capacity and wellbeing of our security forces, government will in the medium term embark on enhancement of pay for our gallant men and women in uniform. Madam speaker, the construction of the Military Referral hospital in Mbuya is on schedule and within budget. Madam speaker, in order to enhance surveillance and improve crime detection, the first Phase of the CCTV camera project was successfully implemented with the installation of over 3,000 cameras country wide.The second phase is now 95 per cent complete, and targets all cities and major highways.

Madam speaker, Shs 3.987 trillion has been provided for improvement of security and security infrastructure.

Rule of Law

Madam Speaker, in order to enhance the rule of law, the priority will be to improve the dispensation of justice for all. The Judiciary will be supported to allow for speedy dispensation of justice and address the backlog of cases.47. In terms of systems that enhance the judicial process, the Electronic Court Case Management Information System (ECCMIS) to improve case management is now functional in seven (7) court circuits within the Greater Kampala Metropolitan Area.

Additionally, the Video Conferencing System is operational in several courts across the country. The rollout of the Electronic Court Case Management Information System and Video Conferencing Systems in an additional ten (10) courts will also commence next financial year.

Madam speaker, administration of Justice will be strengthened with the recruitment of more Judicial Officers; the establishment of two (2) Regional Courts of Appeal in Gulu and Mbarara, and two (2) High court circuits in Luwero and Soroti. In addition, three (3) Chief Magistrate courts in Alebtong, Lyantonde and Budaka; and four (4) Grade I Magistrate courts in Karenga, Patongo, Abim, and Kyazanga districts, will also be established.

Madam speaker, in order to further improve the delivery of justice,the construction of the Supreme court and the Court of Appeal building will be completed soon. In addition, the Chief Magistrates court buildings in Hoima, Luwero and Masindi districts among others, were rehabilitated during the ending financial year.

Madam speaker, over 78 per cent of the population can now access a frontline service point within a five-kilometer radius. District coverage of justice front line service points has increased from 61.5 per cent in2017 to 74 per cent in 2021.

Anti-Corruption

Madam speaker, we continue to make progress in the fight against corruption. There was increased declaration of income, assets, and liabilities by leaders from 25,000 to over 400,000 in 2021, with the increase in the scope of public servants who are required to declare income, assets and liabilities. This financial year, Shs 3.0 billion has been recovered from corrupt leaders and public servants and deposited in the Consolidated Fund.

Madam speaker, to enhance the rule of law and to step up the fight against corruption, I have provided Shs 381.6 billion for the Judiciary, Shs 95.0 billion for the Directorate of Public Prosecutions, Shs 876.4 billion for the Uganda Police, and Shs 308.7 billion for the Uganda Prisons Service. I have also allocated Shs 79.4 billion for the Inspectorate of Government. Implementation of the Parish Development Model. Madam speaker, in order to integrate the 3.5 million households currently working in the subsistence economy into the money economy, and to proactively create wealth and jobs, the Parish Development Model (PDM) is going to be fully implemented in the coming financial year.

Madam speaker, in financial year ending June 2022, Shs 234 billion was provided for the implementation of the PDM. More efforts have been focused on preparatory activities to prepare for full implementation of the model. These include: recruitment of parish chiefs by all districts; data collection, verification of beneficiaries, establishment of SACCOs; setting up of the PDM Management Unit in the Ministry of Local Government; and sensitisation and mobilisation,among others.

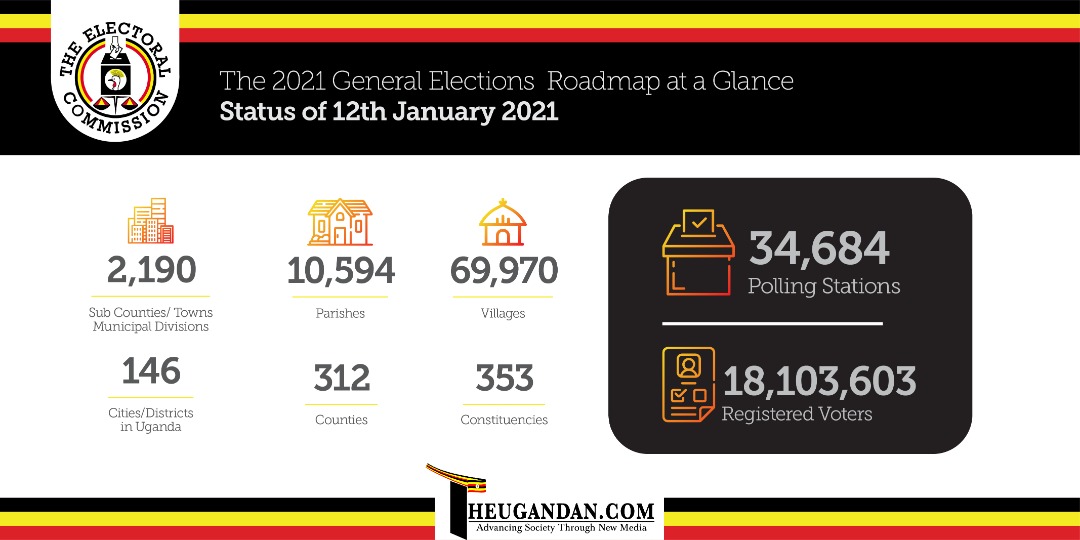

Madam speaker, next financial year, I have provided a total of Shs 1.059 trillion for full implementation of the Model. Each of the 10,594 Parishes in the country will receive Shs 100 million as a revolving fund, earmarked for purchase of agricultural inputs by households still in subsistence. Madam speaker, the Parish Development Model will be complemented by other government programmes such as the Emyooga Fund; the Microfinance Support Centre credit to other SACCOs and Village Savings Groups; the Small Business Recovery Fund; and other wealth creation initiatives.

Agriculture Production

Madam speaker, agriculture production will be enhanced using the first pillar of the Parish Development Model – that addresses production, agro-processing, and marketing, through enhanced access and entry to national, regional and global markets. This value chain approach allows development of sustainable linkages. The key interventions will include: i) Development of key commodities value chains that have a high impact on transforming the 39 per cent of households in subsistence into the money economy. These include coffee, beef and dairy cattle, poultry, fish, piggery, fruits, and food crops for intensive farming.

The rest of the enterprises including cassava,bananas, rice, Irish potatoes, millet, cotton, tea, cashew-nuts, among others, will also be supported but for relatively big farmers; ii) Expansion of irrigation schemes and providing community and individual on-farm water for production to minimise reliance on rain-fed agriculture; and ensuring sustained agricultural production; iii) Enhancement of research, breeding and appropriate technology development through the National Animal Genetic Resources Centre and Data Bank (NAGRC & DB) and the National Agriculture Research Organisation (NARO);

iv) Investment in, and effective regulation of production, multiplication and certification of quality agricultural inputs including seeds,seedlings, stocking materials, and fertilizers;v) Enhancement of enterprise selection through enhanced farmer education and general agricultural extension, as well as pest and disease control at Parish level; vi) Promotion of appropriate land use, mechanisation, cooperatives,and development of partnerships with large-scale farmers to produce for export and industrial value addition; and vii) Supporting fishing communities by developing hatcheries, fishponds, and equipping them with engines, nets etc.

Madam speaker, I have allocated Shs 564.39 billion to increase production and productivity through the ministry of Agriculture. Animal Industry and Fisheries.

Climate Change and Environmental Degradation

Madam speaker, climate change is a significant risk for agriculture production, and food security. In order to mitigate environmental degradation, we have set a target to increase the national forest cover from the current 12.4 per cent to 15 per cent. Central Forest Reserves will be protected from encroachment by re-surveying and marking of 6200 square kilometers of boundary.

Madam Speaker, 850 square kilometers of wetlands and forests will also be restored by i) having them demarcated and gazetting, and ii)evicting all encroachers. Madam speaker, I have allocated Shs 628 billion in the next FY 2022/23 for actions to mitigate and adapt to climate change.

Promoting Agro-Industrialisation, Standards and Market Entry

Madam Speaker, promoting agro-industrialisation, enforcing product standards and enabling market access and entry are key aspects to creating wealth and jobs. Next financial year, the following interventions will be prioritised: i) Expanding storage and processing capacity for agricultural commodities within the 18 zones of the country; ii) Enhancing the use of the Warehouse Receipt System to improve commodity storage, reduce post-harvest losses, improve value chain management, and increase income to farmers;

iii) Providing funds for private sector investment in key commodity agro-processing value chains through soft and patient debt from UDB, and equity from UDC; iv) Strengthening of standards for quality assurance to improve access to markets; v) Establishing a system for issuance and management of internationally recognised product bar codes, branding, packaging and labelling of Uganda’s products for visibility; vi) Enhancing implementation of the Export Development Strategy including carrying out negotiations for access and entry to regional and international markets;vii) Establishing fully serviced industrial parks; viii) Promoting investment in strategic industries such as manufacture of pharmaceuticals, industrial sugar, starch, herbal extracts and cotton-based medical sundries; ix) Finalise the enactment of pending legal instruments, for example, the Competition Bill and the Consumer Protection Bill, Anti-Counterfeits and

Quality Product laws; x) Developing a master plan for the Zombo Tea Factory and establishing enabling infrastructure including water and electricity; xi) Expanding the Soroti Fruit Factory by installing additional processing equipment; and xii) Supporting establishment of 200 Aggregation and Collective Marketing Societies with cleaning, drying, grading, and processing equipment.

I have allocated Shs 1.449 trillion to promote agro-industrialisation, standards and market entry. Supporting Economic Recovery and Commercializing Oil and Gas. Madam speaker, as I reported earlier, we have taken major steps to revive business activity, which we shall continue to do in the medium term in the following sectors:-Tourism.

Madam speaker, tourism was severely affected by the Covid-19 pandemic. The good news is that the sector is recovering fast. Government shall support the sector to return to its pre-pandemic levels and beyond by prioritising the following interventions: i) Facilitation of the Uganda Tourism Board to rebrand and promote Uganda under the new ‘Explore Uganda’ brand;ii) Sustaining and upscaling investment in tourism infrastructure –like roads, electricity, internet, security, etc.;iii) Easing access to recovery financing at the Uganda Development Bank; and iv) Intensifying promotion of domestic tourism.

Madam speaker, I have provided tourism activities with Shs 194.7 billion to complement private sector investment and support its recovery.

Commercialisation of Oil and Gas

Madam Speaker, the construction of the East African Crude Oil Pipeline (EACOP) is expected to commence in the coming financial year. The capacity of the Uganda National Oil Capacity to invest in oiland gas development has also been enhanced. While there have been negative campaigns against the development of the Crude Oil Pipeline,the Government will develop Uganda’s oil and gas resources in a responsible and sustainable manner for the benefit of all Ugandans.

Madam speaker, I have allocated Shs 904.1 billion towards the development and commercialisation of minerals, oil and gas.

Enhancing Human Capital Development

Madam Speaker, having successfully contained the COVID-19pandemic over the last two years, our efforts are going to be focused on improving the quality of life of the people of Uganda by prioritising the following:Health.

Madam speaker, the emphasis now is on mass vaccination of all eligible persons and community disease surveillance by strengthening Village Health Teams (VHTs) with training and equipping them with a smartphone and bicycle. Additional Health assistants and surveillance officers will be recruited to support the VHTs.71. Madam speaker, the development of health infrastructure nationwide will continue. The rehabilitation and expansion of the following General Hospitals will be undertaken – Itojo, Kaabong, Abim,Kambuga, Masindi, Kanungu, Kapchorwa, Bugiri and Amudat. In addition, forty-three (43) Health Centre IIs will be upgraded to Health Centre IIIs and seventeen (17) new Health Centre IIIs will be built in the sub-counties without health facilities. Seventy-five (75) Staff Houses will be built in the Karamoja region.

Madam speaker, next financial year, the Ministry of Health will start implementing the Uganda COVID-19 Emergency Response and Preparedness Project supported by a grant from the World Bank amounting to US Dollars 180.3 million (equivalent to Ushs 667.1billion). This grant will finance the rapid detection, prevention and quick responses to threats posed by the COVID-19 Pandemic. It will also finance the strengthening of national systems for public health preparedness.

Madam speaker, the construction and equipping of a modern heart facility will commence in the coming financial year, to be located in Naguru. This US dollar 70 million facility will be funded by the Arab Bank for Economic Development in Africa (BADEA); the Saudi Fund for Development (SFD); and the OPEC Fund for International Development (OPEC Fund). Madam speaker, I have allocated a total of Shs 3.722 trillion for health care delivery in FY 2022/20223.

Water

Madam speaker, national safe water coverage now stands at 69.8percent, with coverage in rural areas at 68 percent and 71.6 per cent in urban areas. Our target is to increase safe water coverage to 81 per cent over the medium term.

Madam speaker, during financial year 2021/22, the following major water projects were implemented:i) Five medium-scale irrigation schemes in Ngenge (Kween),Rwengaaju (Kabarole), Tochi (Oyam), Mubuku II (Kasese), andDoho II (Butaleja);ii) One Hundred and Six (106) small scale irrigation schemes in the districts of Bugiri, Bukedea, Tororo, Iganga, Mbale, Kapchorwa, Pakwach, and many others;iii) Substantial completion of Katosi Water Treatment Plant, which will produce 160 million litres of water per day; iv) Upgrading of Kapeeka Water Supply System to 5 million liters per day, double the current capacity; and v) Rehabilitation and expansion of the Sembabule Water Supply Project. The Plant is now able to produce 30 million litres per day..

Madam speaker, the following water projects which are ongoing will continue to be implemented:i) Constructing 80 kilometres water supply infrastructure from River Nile to serve 484,000 people in Acholi and Lango sub-regions;ii) Constructing Water Infrastructure from River Kagera to serve an additional 75,000 people in Isingiro, Mbarara, and Masaka sub-regions; iii) The Wakiso West Water and Sanitation Project;iv) The rehabilitation and expansion of Mbale Water Supply Scheme;and v) Construction of the Wastewater Treatment Plant targeting Kiruddu Hospital.

Madam speaker, I have allocated Shs 1.027 trillion towards the water and environment sub-programme.

Education

Madam speaker, education is a key opportunity equaliser for human beings. During the Covid-19 induced lockdown period, many teachers abandoned the profession, and classrooms got dilapidated in several institutions. But now efforts have started to revamp the education sector. Priority will be put on improving the quality of education to enhance learning outcomes. The following will be undertaken: i) Staffing gaps will be filled in primary and secondary schools; ii) Training of teachers and instructors on the new abridged curriculum will continue, and the lower secondary curriculum will be rolled out;

iii) Continuous assessment will be fully rolled out;iv) Inspections across all learning institutions will be strengthened using the Teacher Education and Learning Assessment (TELA)system;v) Operationalisation of the Moroto Constituent College of Agriculture,Mountains of the Moon, and Busoga Universities will take effect.Consultations to operationalise Bunyoro University will commence next financial year 2023/24;vi) Construction and equipping of two-Unit Laboratories in 21 secondary schools currently without any, in line with the ScienceT echnology Engineering and Math (STEM) Policy; and vii) The construction, upgrading and equipping of Vocational Education Centres of Excellence in Bushenyi, Lira, and Elgon technical institutions will be completed.

Madam speaker, I have allocated Shs 4.14 trillion towards the education and skilling sub-programmes.

Science and Innovation

Madam speaker, we are developing three prospective COVID-19 vaccines which are undergoing animal trials. Human trial will commence next financial year. In addition, clinical trials for COVID-19 treatment for viral respiratory diseases are on-going. Next financial year, research into medicine development will be expanded to cancer,diabetes, sickle cell anemia, and malaria.

Madam speaker, in September this year Uganda will launch into the Lower Earth Orbit its first ever satellite from the International Space Station in collaboration with the US National Aeronautic and Space Administration (NASA). A ground station at Mpoma, Mukono will receive data from the satellite. The data from this satellite will be used for meteorology, environmental monitoring, urban planning, mineral exploration, and disaster management, among others. Madam speaker, I have allocated Shs. 274.4 billion towards advancing innovation and technological development in this country.

Enhancing the Transport and Power Infrastructure

Madam speaker, the following achievements have been recorded in transport infrastructure development:i) The construction and up-grading of 20 national roads covering a total distance of 1,437 kilometers have been done; ii) The rehabilitation has commenced of the 160 kilometres of Tororo-Gulu Meter Gauge Railway and the 265 kilometres of Tororo-Namanve Railway line section. The procurement of locomotives is on-going; iii) Continuation with the compensation and acquisition of right of way for the Kampala – Malaba Standard Gauge Railway line; iv) The rehabilitation of the Entebbe International Airport stands at 75 per cent completion and the Kabaale International Airport at 72 per cent; and v) Maintenance of 5,200 kilometres of paved and 15,350 kilometres of unpaved national and city roads, and 21,831 kilometres of unpaved Local Government and Community roads has been undertaken.

Madam speaker, next FY 2022/2023, the following interventions in transport infrastructure will be implemented:-i) Construction of 400 kilometres equivalent of roads to bitumen standards; rehabilitation/reconstruction of 200 kilometres equivalent, and construction of 30 bridges on the National roads network; ii) Rehabilitation of 928 kilometres of district roads and 126 kilometres of Local Government roads; iii) We shall continue with the development of the Bukasa Inland Port;and iv) We shall commence Uganda Airlines’ flights to London and China.

Madam speaker, I have allocated Shs 4.3 trillion next financial year for transport infrastructure development and maintenance.

Power Infrastructure

Madam Speaker, national electricity access today stands at 57 per cent, of which, 19 per cent is on the main national grid and 38 per cent is off-grid, including solar power. Uganda’s total electricity generation capacity has increased from 1,268 megawatts in Financial Year 2019/2020 to 1,347 megawatts in FY 2021/2022, on account of the completion of the 42 megawatts Achwa I, the 21megawatts Nyamagasani, and the 15.5 megawatts Sugar Corporation of Uganda Limited (SCOUL) plants.

The transmission network increased from 3,100 kilometres in FY 2020/2021 to 3,431 kilometres as at the end of the third quarter FY 2021/22 as a result of the commissioning of the Karuma-Kawanda 400 kV and Karuma-Olwiyo 132 kV Transmission Lines. The Luzira Sub-station was completed and will be commissioned after completion of the 15 kilometres 132kV transmission line.

Madam speaker in the next financial year, the following interventions in power infrastructure will continue to be implemented: i) Commence the unit-by-unit commissioning of the 600 megawatts Karuma Hydro Plant in September 2022, with the plant being fully available in June 2023; 29 ii) Complete the Opuyo-Moroto, Lira-Gulu-Nebbi-Arua, Lira-Gulu-Agago and the Mutundwe – Entebbe 132kV transmission lines; and

iii) Commence feasibility and design studies for the 400kv Uganda -South Sudan transmission line between Olwiyo – Nimule -Juba; the400kV Uganda – Democratic Republic of the Congo interconnectionand the 400KV Uganda – Tanzania transmission line. Madam speaker, I have provided Shs 1.573 trillion to ensure theabove are undertaken.

Information Communication Technology Infrastructure

Madam speaker, the geographical coverage of Broad Band services(3G) stands at 66 percent, allowing digital access for 74 per cent of thepopulation. Next financial year, the government will support theFourth Industrial Revolution Technologies. These include Artificial Intelligence, Internet of Things (IoT) and the use of Robotics. We shallalso extend broadband ICT infrastructure to enable connectivity tofacilitate public service delivery. Madam speaker, I have allocated Shs 124.2 billion towards digitalisation.

Enhancing Public Sector Effectiveness and Efficiency

Madam speaker, Public Sector effectiveness and efficiency will beimproved through the following measures:i) Continued rationalisation of Government and Public Expenditure;ii) Automation of Government business and service delivery. This includes e-Procurement, the Parish Model ManagementInformation System, Government Asset Management, Education Information Management, Electronic Document Management, Integrated Health Management Information System, e-PaymentGateway, and the e-Post Digital Platform; iii) We shall also embark on decongesting the Citizenship andImmigration Office in Kampala by establishing centers in the Kampala Capital City Divisions, commencing with NakawaDivision; iv) The salaries of medical workers, scientists, and science teachershave been enhanced by Shs 495 billion. In addition to incentivizing scientists, this will also help to improve functionalityof education and health facilities by addressing absenteeism andlow morale of personnel; and v)

Madam speaker, to enhance the Decentralisation Policy, a total of Shs. 5.1 trillion has been provided as direct financing to Local Governments.

FISCAL FRAMEWORK AND THE FINANCING STRATEGY FOR FINANCIAL YEAR 2022/2023

Madam Speaker, the FY 2022/23 budget priorities I havejust elaborated will be financed from the following sources: i) Enhanced domestic revenue mobilization; ii) External financing in the form of loans and grants from our Development Partners and private creditors; and iii) Public-Private Partnerships that mobilise private sector financingfor public projects. The Resource Envelope for FY 2022/23.

Madam speaker, the resource envelope for FY 2022/23 amounts to Shs 48,130.7 billion and is comprised of both domesticand external resources as detailed below: -i) Domestic Revenue amounts to Shs 30,797.3 billion of which Shs 23,754.9 billion will be tax revenue and Shs 1,795.9 billion will be Non-Tax Revenue. ii) Domestic borrowing amounts to Shs 5,007.9 billion.iii) Budget Support accounts for Shs 2,609.2 billion.

iv) External financing for projects amounts to Shs 6,716 billion ofwhich Shs 4,625.7 billion is from loans, and Shs 2,090.5 billion is from grants. v) Appropriation in Aid, collected by Local Governments amounts to Shs 238.5 billion; and vi) Domestic Debt Refinancing will amount to Shs 8,008.0 billion.

Madam speaker, total expenditure will be Shs 48,130.7 billion. Excluding domestic debt refinancing and Appropriations in Aid (AIA), it amounts to Shs. 39,884.2 billion of which Wages and Salaries is Shs. 6,366.9 billion, Interest Payments is Shs. 4,691.9 billion, Non-wage Recurrent Expenditure is Shs. 14,259.4 billion andDevelopment Expenditure is Shs. 14,565.9 billion.

Tax Measures for FY 2022/2397. Madam speaker, no new taxes will be introduced in Financial Year2022/23. We will achieve revenue targets by improving the efficiencyin tax collection and enhancing compliance to tax laws. The capacityof the Uganda Revenue Authority will be enhanced by recruiting andtraining staff, deploying appropriate equipment and ICT to enforce taxlaws.

Madam speaker, I wish to report that Parliament has madeamendments to the various tax laws intended to simplify the laws,clarify previously ambiguous provisions and close loopholes that maylead to revenue leakage. Madam speaker, the amendments that have been made are in the Income Tax Act, Value Added Tax, the Stamp Duty Act and the Tax Procedures Act. I will now highlight the major amendments.

Income Tax

Madam speaker, the corporate income tax exemption for Bujagali Hydro Power Project has been extended for one (1) year up to 30thJune 2023 in order not to increase electricity tariffs for power that the Project generates.

Madam speaker, the income tax Act has been amended to streamlinethe rental income tax regime for individuals and non-individuals asfollows: -i) Introduce a zero rental income tax rate for individuals that earn annual rental income not exceeding Shs 2,820,000 and a rate of12 percent of rental income exceeding that amount; and ii) For rental business, introduce a 30 percent rental income tax rate on rental income with expenses capped to 50 per cent for each yearof income.

In addition, any excess expenses shall not be carriedforward to a subsequent year of income.

Value Added Tax

Madam speaker, under the Value Added Tax Act, the following amendments have been made:-i) Exempted the supply of oxygen cylinders or oxygen for medical useto reduce the cost of the supply of oxygen for medical use;

ii) Exempted the supply of assistive devices for persons with disabilities to reduce the cost of the equipment used by persons with disabilities; iii) Exempted the supply of airport user services charged by the Civil Aviation Authority to reduce the cost of transiting through Entebbe Airport;iv) To allow for Cash Basis Accounting for suppliers who supply goodsand services to Government to facilitate them to hedge against the risk of interest and penalties arising from delayed payments byGovernment; and v) Repealed the exemption on VAT on imported services used in the provision of an exempt supply to encourage business to use localsuppliers of services such as Information and Communications Technological services.

Tax Procedures Code

Madam speaker, the amendments under the Tax Procedures CodeAct, include the following: -i) Introduced penalties for failure to provide information for purposesof Automatic Exchange of Information to improve compliance; and ii) Introduced penalties for failure to adhere to Electronic Fiscal Receipting and Invoicing Solution and Digital Tax Stamps. This isintended to combat tax evasion, smuggling, and other vices.

Stamp Duty

Madam speaker, under the Stamp Duty, the following amendmentshave been made: -i) Provide for NIL stamp duty on the following instruments; a. Agreements relating to the deposit of title deeds or personalproperty or goods to another as a pledge or as security for a sum of money borrowed. b. Agricultural Insurance Policy, to encourage the uptake ofagricultural insurance services; and c. Security Bond or Mortgage Deed executed by way of security for the due execution of an office, or to account for money or other property received by virtue of security bond or mortgage deed executed by surety to secure a loan or credit facility. ii) Clarification of the rate of Shs 15,000 applicable on thetransmission of property from the Administrator of an Estate to the Beneficiary.

Excise Duty

Madam speaker, under the Excise Duty Act, the Government has undertaken the following amendments: -i) Clarification of definitions of various products that attract exciseduty such as spirits and juices to enhance taxpayer compliance;and ii) Reduced excise duty applicable on opaque beer and fermentedbeverages made from locally sourced raw materials to 12 per cent or Shs 150 per litre, whichever is higher.

This is intended to promote value addition and the use of locally sourced raw materials.

The Medium-Term Financing Strategy

Madam speaker, the financing of the budget will be generated fromthe implementation of the following revenue and public debt measures

Domestic Revenue Mobilisation Strategy

Madam speaker, the objective of the Government in FY 2022/23 is to increase revenue by 0.8 per cent of GDP. The major assumptions that underpin this goal are: (i) expected increase in taxable economic activities, (ii) gains from revenue enhancement measures, and (iii) increased employment, and aggregate demand forgoods and services arising from the full reopening of the economy.

Public Investment Financing Strategy

Madam speaker, the government will implement the Public Investment Financing Strategy starting next financial year, toachieve the following objectives. i) Improve alignment of suitable financing options to Government Programmes and projects; ii) Minimise the cost and risk exposure of financing modalities; iii) Ensure prudent loans acquisition to avoid debt accumulation in ashort period, and timely disbursement of loan funds; iv) Long term fiscal sustainability; v) Increase financing from traditional and other innovative sourcesto meet the development financial requirements; and vi) Provide a framework for partnership with the private sector in theimplementation and financing of public investment programmes.

Public Debt Management

Madam speaker, as at the end of December 2021, Uganda’s totalpublic debt stock stood at Shs 73.5 trillion (equivalent to USD 20.7 billion), of which External Debt amounted to Shs 45.72 trillion (equivalent to US Dollars 12.9 billion) and Domestic Debt amounted to Shs 27.77 trillion (equivalent to US Dollars 7.84 billion).

This represents nominal debt to GDP ratio of 49.7 per cent. The rise in the debt stock was mainly on account of the need to support the economy and preserve the welfare of households a resultof COVID-19, and other external and domestic shocks. Debt was alsoused to finance the shortfalls in domestic revenue.

Madam speaker, the government is implementing the followingmeasures to ensure long term public debt sustainability:-i) Reduce the level of domestic borrowing over the medium term toan average of 2.2 percent of GDP per year. This ratio will bereduced further to a policy target of 1.0 percent of GDP over thelong term;ii) Implement the Public Investment Financing Strategy.

This strategy will ensure alignment of suitable financing modalitieswith the nature of Government programmes and projects;iii) Implement the FY 2022/23 borrowing strategy which is consistent with our Medium-Term Debt Management Strategy,to avoid risks associated with unsustainable debt;iv) Borrow largely on favourable terms and for projects that enhance the productivity of the economy; v) Sequencing new projects in a manner that makes the Government service its debt obligations without the risk of default. This means the Government will only mobilise debt financing for readyprojects and will cancel projects with poor performance; andvi) Increase domestic revenue by implementing the DomesticRevenue Mobilisation Strategy.

CONCLUSION

Madam speaker, the budget for the next financial year presents a setof strategic choices and the government’s commitment to stimulate economic recovery, enhance productivity and competitiveness of enterprises, and most importantly wealth creation and jobs for theordinary Ugandans.

Substantial resources have been earmarked for the implementationof the Parish Development Model. This model will be the vehicle for socioeconomic transformation at the parish level, and the monetization of the Ugandan economy.

Successful implementation of the Parish Development Model ushers in a mass socio-economic transformation movement in our society with better-sustained outcomes. I, therefore, urge all leaders and Ugandans to ensure that these resources are effectively used to bring about the desired change. To the Ugandan Scientists and Health Workers, Government has fulfilled its commitment to enhancing your pay. Ugandans expect better services in return.

To the Micro, Small, and Medium Enterprises (MSMEs), I implore you to take advantage of the Economic Recovery programs, andthe opportunities that come with petroleum and other publicinfrastructure investments, to re-strategize, recover your businesses, expand, and formalize. This way, you will be able to benefit morefrom the now bigger EAC market and create decent and better-payingjobs for our young people.

For the women entrepreneurs, the Grant from the World Bank willsupport the growth of your enterprises, create better-paying jobs andenable you to exploit the opportunities in the economy to enhanceyour incomes.

Madam speaker, in order to improve service delivery, my Ministry together with our budget transparency partners has introduced service excellence awards for the best performing Ministries, Departments, and Agencies (MDAs) and Local Governments, as part of the Budget month.

At an appropriate time in the near future, H.E the President will present awards of recognition to the best performing MDAs for financial year 2021/22.118. Madam speaker, I dedicate this Budget to delivering the Ugandan households still in the subsistence to the money economy.

I thank you all for listening.

For God and My Country.