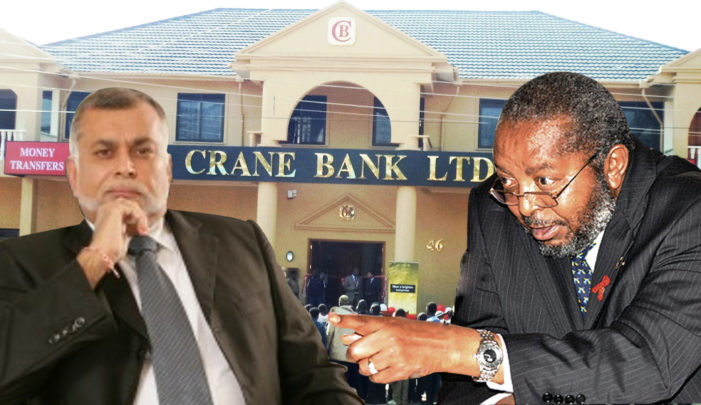

Former Crane Bank owner and city businessman Sudhir Ruparelia should not be arrested and arraigned before court over the money that was lost before Bank of Uganda wrestled the bank from him.

According to media reports on Tuesday, that is one of the recommendations of the central bank’s forensic audit report into Crane Bank.

Crane Bank may have been sold to dfcu Bank but the report also suggests Ruparelia must cough almost US$60M (Shs200billion) that was found untraceable within a period of 18 months and payable in installments.

“There was a loss. So what do you do? Now you have to ascertain how this loss came up. In order to ascertain this, you carry out a forensic investigation because you want to know; why the loss, who caused the loss and what course of action should you take in case you find out whether there were people involved. The investigation will have numbers as well as legal implications,” Ms Justine Bagyenda, the executive director supervision at BoU, said early this year.

By October 2016, Crane Bank could even no longer access money in the interbank market from other commercial banks because of concerns about its ability to finance those borrowings.

That in part explains why BoU had to inject about Shs200b liquidity in the three months when BoU was operating Crane Bank.

In Crane Bank’s 2015 financial statements, they indicated that they had assets of Shs1.8 trillion and liabilities of about Shs1.6 trillion, of which Shs1.3 trillion were deposited from customers.

Crane Bank was controlled by the Sudhir Ruparelia family at 47 per cent, with MS White Sapphire, a company domiciled in the Mauritius, holding 46 per cent of the shares.